VANCOUVER, British Columbia, Sept. 04, 2024 (GLOBE NEWSWIRE) -- Fireweed Metals Corp. (“Fireweed” or the “Company”) (TSXV: FWZ; OTCQX: FWEDF) is pleased to announce the updated Mineral Resource Estimate (“MRE”) for the Tom and Jason deposits, as well as the inaugural resource estimates for the Boundary Zone and End Zone deposits at the Macmillan Pass Project (“Macpass”). The MRE was prepared by SLR Consulting (Canada) Ltd. in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under National Instrument 43-101 (“NI 43-101”).

Peter Hemstead (Interim CEO) commented, “The delivery of the updated Mineral Resource Estimate for the Macpass project marks another key milestone in demonstrating the exploration potential of the Macpass district. The team has increased the contained zinc equivalent* metal in the Indicated Resources category by approximately 300% and more than doubled the overall tonnage. The addition of Boundary Zone now positions Macpass as one of the world’s largest undeveloped primary zinc districts1.”

Mineral Resource Estimate Highlights

- Global Mineral Resource Estimate comprising:

- An Indicated Resource of 56.00 Mt at 7.27% Zinc Equivalent (“ZnEq”)* (5.49% zinc, 1.58% lead, and 24.2 g/t silver).

- An Inferred Resource of 48.49 Mt at 7.48% ZnEq* (5.15% zinc, 2.08% lead, and 25.3 g/t silver).

- Macpass is now one of the world’s largest undeveloped primary zinc districts1.

- Contained ZnEq* metal in the Indicated Resources category increased by approximately 300% compared to the 2018 resource estimate2.

- The resource estimate is supported by verified data, robust geological models, well-defined estimation domains, constrained with open pit shells and underground mining shapes and supported by thorough sensitivity analysis.

- Fireweed continues to build and prioritize a portfolio of targets through a large regional exploration campaign in an under-explored land package (977 km2).

Dr. Jack Milton, VP Geology, commented, “This resource is the culmination of six years of exploration success at Macpass, including an additional 43,000 metres of drilling at Tom, Jason, End Zone, and our discovery at Boundary Zone, which is one of the most globally significant zinc discoveries of the last 15 years1. We have more than doubled the tonnage from our previously reported resource2, increased the contained zinc metal by 83%, and added open-pit and underground mining volume constraints for reporting. The potential for by-product gallium and germanium could enhance the Macpass district with further critical minerals exposure. The deposits remain open along strike and at depth and, with the 2024 drill program (14,000 m) not yet included in this MRE, there exists the potential for an increase to the resource as part of future technical work. In addition, we are undertaking a large and comprehensive regional exploration program to continue to provide a pipeline of high-quality targets for future testing.”

Conference Call and Webinar

Investors, media, and the public are invited to join the conference call and webinar hosted by Dr. Jack Milton, P. Geo., during which management will discuss the result of the Macpass MRE update as reported in this release.

- September 5, 2024, at 9:00am PT (12:00pm ET)

- Toll-free in U.S. and Canada: +1 (844) 763-8274

- All other callers: +1 (647) 484-8814

- Webinar: https://www.c-meeting.com/web3/joinTo/M94CVMUU83PQMW/vobcPfLtLGOvjaB9xTlsxQ

- Webinar replay: Available on the Company’s website for one year.

Global Mineral Resource Estimate

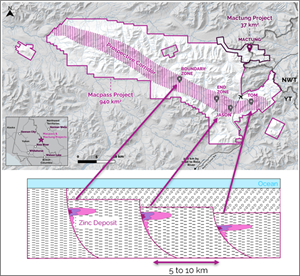

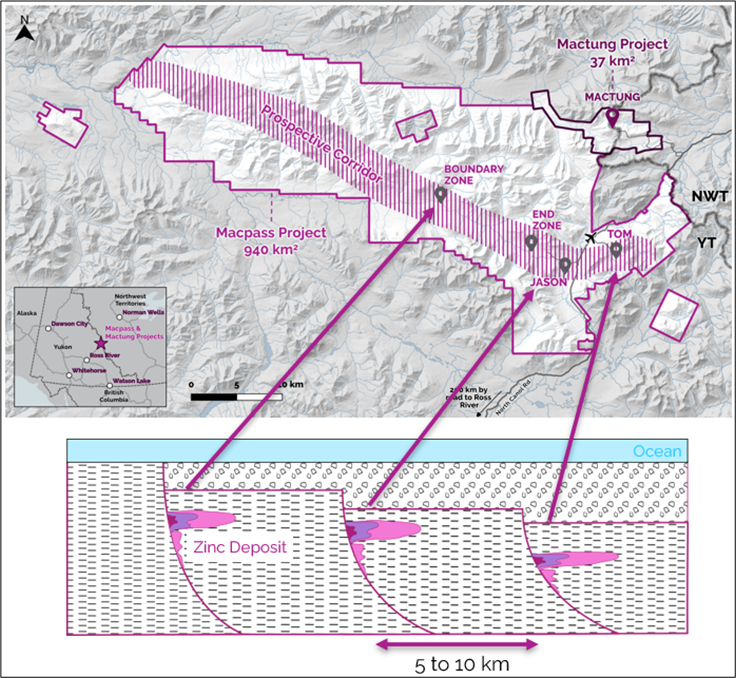

The MRE at Macpass is comprised of four distinct deposits: Tom, Jason, End Zone, and Boundary Zone (Figure 1). Table 1 lists the global mineral resources for Macpass by deposit.

Table 1: Macpass Project Global Mineral Resource Estimate by Deposit (combined OP and UG constrained resources).

| 2024 SLR Class | Deposit | Tonnes (Mt) | ZnEq (%) | Zn Grade (%) | Pb Grade (%) | Ag Grade (g/t) | Zn Contained Metal (Mlbs) | Pb Contained Metal (Mlbs) | Ag Contained Metal (Moz) |

| Indicated | Tom | 17.52 | 9.90 | 6.30 | 3.34 | 33.0 | 2,435 | 1,291 | 18.56 |

| Jason | 3.80 | 9.09 | 7.62 | 1.86 | 1.7 | 638 | 156 | 0.21 | |

| End Zone | 0.34 | 16.15 | 3.81 | 12.32 | 86.2 | 29 | 93 | 0.95 | |

| Boundary Zone | 34.34 | 5.63 | 4.86 | 0.55 | 21.6 | 3,682 | 412 | 23.83 | |

| Total Indicated | 56.00 | 7.27 | 5.49 | 1.58 | 24.2 | 6,784 | 1,952 | 43.54 | |

| Inferred | Tom | 18.94 | 9.10 | 6.56 | 2.30 | 25.2 | 2,738 | 960 | 15.37 |

| Jason | 11.65 | 10.40 | 5.48 | 4.33 | 48.2 | 1,407 | 1,112 | 18.05 | |

| End Zone | 0.44 | 8.76 | 1.86 | 6.88 | 48.1 | 18 | 67 | 0.68 | |

| Boundary Zone | 17.46 | 3.75 | 3.48 | 0.23 | 9.5 | 1,337 | 87 | 5.32 | |

| Total Inferred | 48.49 | 7.48 | 5.15 | 2.08 | 25.3 | 5,500 | 2,227 | 39.42 | |

Table 1 footnotes:

- All mineral resources have been estimated in accordance with CIM definitions, as required under NI 43-101.

- Data for this mineral resource estimate has been independently reviewed and validated by a third-party consultancy, SLR Consulting (Canada) Ltd.

- Pierre Landry P.Geo. of SLR Consulting (Canada) Ltd. (“SLR”) is independent of Fireweed Metals Corp., and a ‘Qualified Person’ as defined under NI 43-101. Pierre Landry is responsible for the Macpass Mineral Resource Estimate.

- g/t: grams per tonne; Mlbs: million pounds; Moz: millions of troy ounces; Mt: million metric tonnes.

- Mineral resources are reported within conceptual open pit (“OP”) shells and underground (“UG”) mining volumes to demonstrate Reasonable Prospects for Eventual Economic Extraction (“RPEEE”), as required under NI 43-101; mineralization lying outside of the OP shell or UG volumes is not reported as a mineral resource. Note the conceptual OP shell and UG volumes are used for mineral resource reporting purposes only and are not indicative of the proposed mining method; future mining studies may consider UG mining, OP mining or a combination of both. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

- All quantities are rounded to the appropriate number of significant figures; consequently, sums may not add up due to rounding.

- All prices in Canadian dollars unless otherwise stated.

- Open Pit mineral resources are reported at a pit wall angle of 45°, Revenue Factors of 0.8 (Tom, End Zone), 0.6 (Jason), 1.0 (Boundary Zone), and Net Smelter Return (“NSR”) cut-off of $30/tonne (“t”).

- Underground mineral resources are constrained within reporting panels with heights (H) of 20 m, lengths (L) of 10 m, with 10 m H and 5 m L sub-shapes and minimum widths of 2 m at Tom, Jason, and End Zone; and 20 m H by 20 m L with 10 m sub-shapes and a minimum width of 5 m at Boundary Zone, using an average panel NSR cut-off of $112/t.

- NSR block values and zinc equivalency are based on a price of US$1.40/lb Zn, US$1.10/lb Pb, and US$25/oz Ag, CAD:USD exchange rate of 1.32, and a number of operating cost and recovery assumptions specific to each deposit or mineralization domain (see Tables 2 and 3).

- ZnEq has been calculated on a block-by-block basis using the NSR calculation and input parameters related to each deposit or mineralization domain (Tables 2 and 3). For reporting subtotals and totals, ZnEq values have been calculated using the mass weighted average of the ZnEq block values of each respective domain for its respective classification category within OP and UG reporting volumes.

- The effective date of the MRE is September 4, 2024 and the MRE is based on all drilling data up to and including holes drilled in 2023 with a final database cut-off date of June 23, 2024. The MRE does not include any data from holes drilled in 2024.

- Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that these inferred mineral resources will be converted to the measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

Deposit Geology

The Tom, Jason, End Zone, and Boundary Zone deposits are examples of stratiform, strata-bound sediment hosted zinc-lead-silver deposits. Historically the term SEDEX was used to describe these deposits of Yukon’s Selwyn Basin and since then the term has been used to describe these deposits worldwide. This class of deposits are now referred to as sediment hosted massive sulphide deposits and are also known as clastic-dominated or “CD” deposits. Previously considered to be formed strictly at the sediment-seawater interface by the exhalation of mineralizing fluids in seafloor environments, the model at Tom, Jason, End Zone and Boundary Zone has subsequently been reinterpreted to involve the replacement of porous, poorly consolidated muddy to silty, barite-rich sediment in the sub-seafloor environment.

Mineralization at these deposits comprises an early stage of finely laminated and stratiform pyrite, sphalerite, and galena grading to semi-massive and massive sulphides with increasing proximity to feeder structures, and these intervals are associated with barite-rich layers at multiple stratigraphic levels within black mudstone sequences. At Boundary Zone a later, cross-cutting style of mineralization is also present, forming discrete, broadly stratiform bodies consisting of breccia and veins of pyrite, sphalerite, and galena; flooding and replacement of matrix material by pyrite, sphalerite, and galena; all accompanied by abundant siderite and hosted in conglomerates, diamictites, mudstones, and carbonate-altered mafic volcaniclastic rocks.

Geological domains have been modeled at Tom, Jason, End Zone, and Boundary Zone representing the primary mineralization styles. These domains represent contiguous bodies and vary in complexity between deposits and lenses. At Tom, the main stratiform mineralized zone has been sub-domained into distinct facies to support a detailed estimation model. At Boundary Zone, the early phase of mineralization is represented by the massive sulphide domain, the later phase by the Boundary Vein domains, and surrounding low-grade mineralization is captured in the Boundary Halo domain. Further details will be available in the technical report.

The Macpass MRE is based on 124,632 m of drilling, including historical (pre-2017) and contemporary (2017-2023) drilling across 544 drill holes from 1952 to 2023. The estimate is based on drilling up to and including TS23-009D2, completed October 15, 2023 using a final database cut-off for 2023 and earlier drilling of June 23, 2024.

Detailed geological and fault models were created in 3D for each of Tom, Jason, End Zone and Boundary Zone. These models use a sequence stratigraphic approach and are based on an improved understanding of the regional stratigraphy and structural setting of the deposits. A mineralization model was developed using the geological domains as a framework for defining estimation domains. Contact-plot analysis was used to determine how composite samples should be managed at domain contacts during estimation.

Data Verification

The data used in this Mineral Resource Estimate is supported by Quality Assurance and Quality Control ("QA/QC") procedures, such as the insertion of certified standards and blanks into the sample stream and the utilization of certified independent analytical laboratories for all assays. Historical QA/QC data and methodology on the project were reviewed and will be summarized in the NI 43-101 technical report. No significant QA/QC issues were discovered during review of the data.

The QP is of the opinion that the sample preparation, analysis, and security procedures at Macpass are sufficient for estimating Mineral Resources. Additionally, the QP is of the opinion that the QA/QC program designed and implemented by Fireweed is adequate, and the assay results in the database are suitable for use in the Mineral Resource Estimate.

Data verification for the drill hole database involved cross-checking database analytical values with digital laboratory analysis certificates. These certificates were directly sent to the Fireweed database manager by Bureau Veritas before being passed on to SLR. The verification process also included validating historical assay results from previous operators using a selection of historical certificates, which were scanned from the original paper copies by Fireweed.

In accordance with NI 43-101, Pierre Landry, P.Geo., of SLR, conducted a site visit to Macpass and related facilities from September 15th to 17th, 2022. During this visit, Mr. Landry inspected the core shack, core scanning workspace, and reviewed the logging environment and procedures for data collection and sampling. He also examined core samples from the Tom, Jason, End Zone, and Boundary Zone deposits, interviewed Fireweed Metals personnel, and gathered other information necessary for completing the Mineral Resource Estimate and accompanying technical report. Additionally, Mr. Landry inspected drill collars and drill hole cores relevant to the Mineral Resource estimation, including checking collar locations with a handheld GPS and visually comparing mineralization with interpreted drilling sections. Fireweed Metals provided full access to all facilities and personnel during the site visit. During the visit Mr. Landry was accompanied by Dr. Jack Milton, Vice-President, Geology for Fireweed Metals.

A full description of the data QA/QC will be available in the technical report for the mineral resource update.

Mineral Resource Estimation Methodology

A data-driven approach was used to define grade caps for zinc, lead, and silver within each estimation domain. Assay caps were applied prior to compositing. Regressions of measured densities against the sum of assay values (Zn+Pb+Ba+Fe) were developed for each deposit or domain in order to estimate densities of samples that lack density measurements using assay values. Variography and trend analysis were considered for domains with sufficient data support, and dynamic anisotropy was implemented in the estimate, guided by the mineralization contacts with the wall rock or other sub-domains where applicable. Density-weighted composites were used for the interpolation of grades into the block model using inverse distance squared (ID2) interpolation and compared against nearest neighbor (NN) via swath plots and tables for consistency. High-grade search restrictions were implemented within certain domains. Sub-block models were created using a 5 m parent cell size with sufficient sub block increments to accurately reproduce the wireframe volumes. Density was estimated into each block using length-weighted density composites for each mineralization domain. Fixed, average values of density were assigned to each of the areas of the model outside the mineralization domains.

Resource category classification was determined using a combination of drillhole spacing, geological continuity, grade continuity, mineralization width, and data quality. Inferred and Indicated categories were assigned, and no Measured resources were defined.

Metallurgy

The metallurgical variability of the Tom, Jason, and Boundary Zone deposits has been previously disclosed and shown to have positive metallurgical performance, producing high grade concentrates with high recoveries (see Fireweed News Releases May 15, 2018, and November 1, 2022). Another test program was completed in 2023 that focused on understanding the performance of the massive sulphide mineralization domain at Boundary Zone. Two composites were generated from drillholes NB21-001 and NB20-004, and open circuit tests were completed using the flowsheet from 2022 as a basis. Initial metallurgical performance of the samples is deemed as positive with representative results for each Boundary Zone domain given in Table 2.

Table 2: List of Deposit-Specific Metallurgical Assumptions for NSR and ZnEq Calculations.

| Category | Unit | Tom, Jason & End Zone | Boundary Zone Massive Sulphide | Boundary Zone Vein | Boundary Zone Halo |

| Recovery Zn, Zn Conc | % | 89% | 85% | 88% | 80% |

| Recovery Ag, Zn Conc | % | 22% | 30% | 22% | 22% |

| Recovery Pb, Pb Conc | % | 75% | 55% | 55% | 38% |

| Recovery Ag, Pb Conc | % | 59% | 40% | 30% | 20% |

| Zn Concentrate Grade Zn | % | 58% | 49% | 56% | 58% |

| Zn Concentrate Grade Hg | g/t | 155 | 777 | 693 | 922 |

| Hg Penalty | USD$/dmt | $0.00 | $14.11 | $11.63 | $21.63 |

| Pb Concentrate Grade Pb | % | 62% | 45% | 46% | 44% |

| Zn Conc Payable Zn | % | 85% | 84% | 85% | 85% |

| Pb Conc Payable Pb | % | 95% | 93% | 93% | 93% |

Net smelter return (“NSR”) values were calculated on a block-by-block basis using zinc, lead, and silver block grades with the input parameters listed in Tables 2 and 3. For NSR and ZnEq calculations, fixed values are applied to all blocks within each domain for: metallurgical recoveries; grades of Zn, Pb, and Hg in Zn and Pb concentrates; mercury penalties; and payability of Zn and Pb. Silver grades and payability in zinc and lead concentrates were calculated on a block-by-block basis. For silver grades in lead concentrates less than 620.0 g/t, a minimum deduction was applied of 31 g/t silver with a maximum payability of 95% for silver in lead concentrates. For silver grades in zinc concentrates less than 311.0 g/t, a minimum deduction was applied of 93 g/t silver with a maximum payability of 70% for silver in zinc concentrates.

Table 3: List of Global Assumptions for NSR Calculations, Cut-off-grade Determinations, and Reporting Parameters

| Category | Unit | Parameter |

| Cut-off grade | $/t NSR | $112.00 UG/ $30.00 OP |

| Processing | $/t milled | $22.00 |

| G&A | $/t milled | $8.00 |

| Mining (OP) | $/t moved | $4.67 |

| Mining (UG) | $/t milled | $61.00 |

| UG Sustaining (capex) | $/t milled | $21.00 |

| Foreign Exchange rate | CAD:USD | 1.32 |

| Transport Costs | $/wmt conc | $293.55 |

| Treatment Charges Zn/Pb | USD$/dmt conc | $225.00/$150.00 |

| Concentrate moisture content | % | 8.0 |

| Silver Refining Costs | USD$/oz | $1.25 |

| Zn Price | USD$/lb | $1.40 |

| Pb Price | USD$/lb | $1.10 |

| Ag Price | USD$/oz | $25.00 |

| Royalty | NSR % | 0.00 |

Mining Constraints

Blocks were constrained by OP shells and UG mining shapes at a base case mining scenario to demonstrate RPEEE at an NSR cut-off of $30/t OP and $112/t UG. The cut-off grades were selected using cost estimates listed in Table 3 that assume: a mill throughput rate of 10,000 tonnes-per-day (tpd); open-pit mining rates of 10,000 tpd; and underground mining rates of 5,000 tpd per deposit.

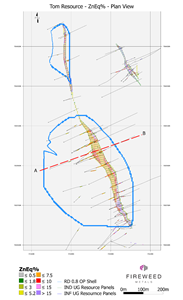

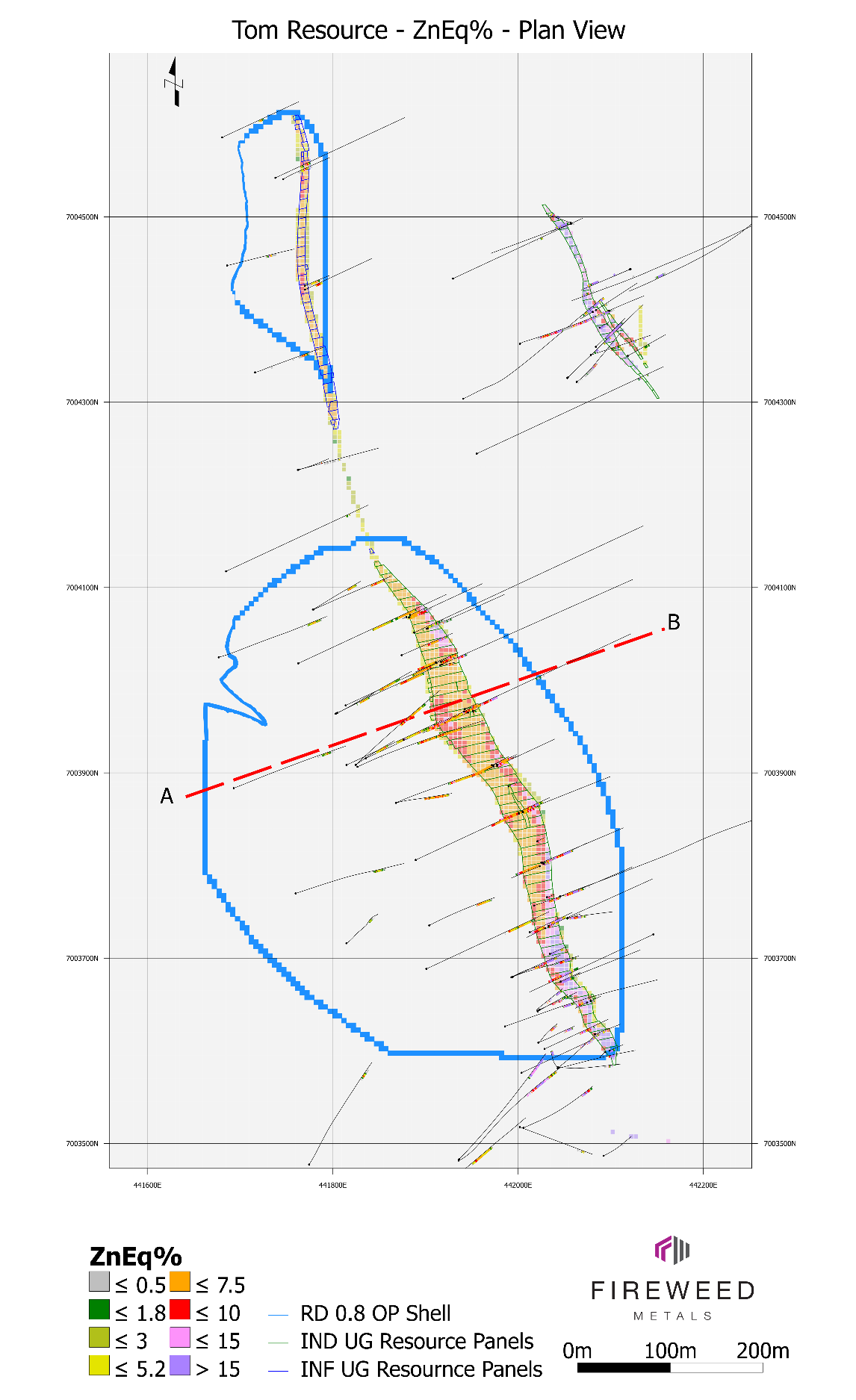

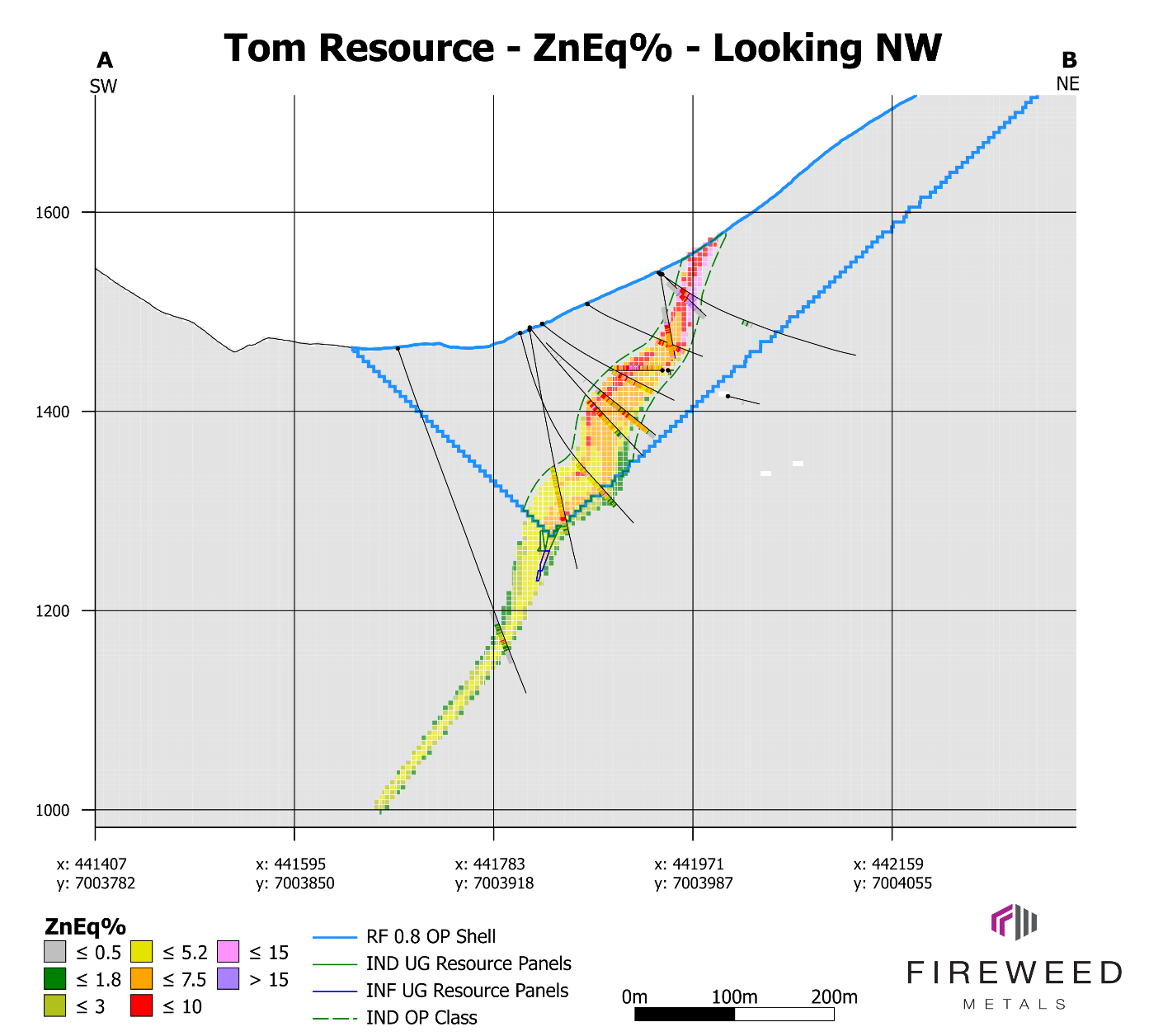

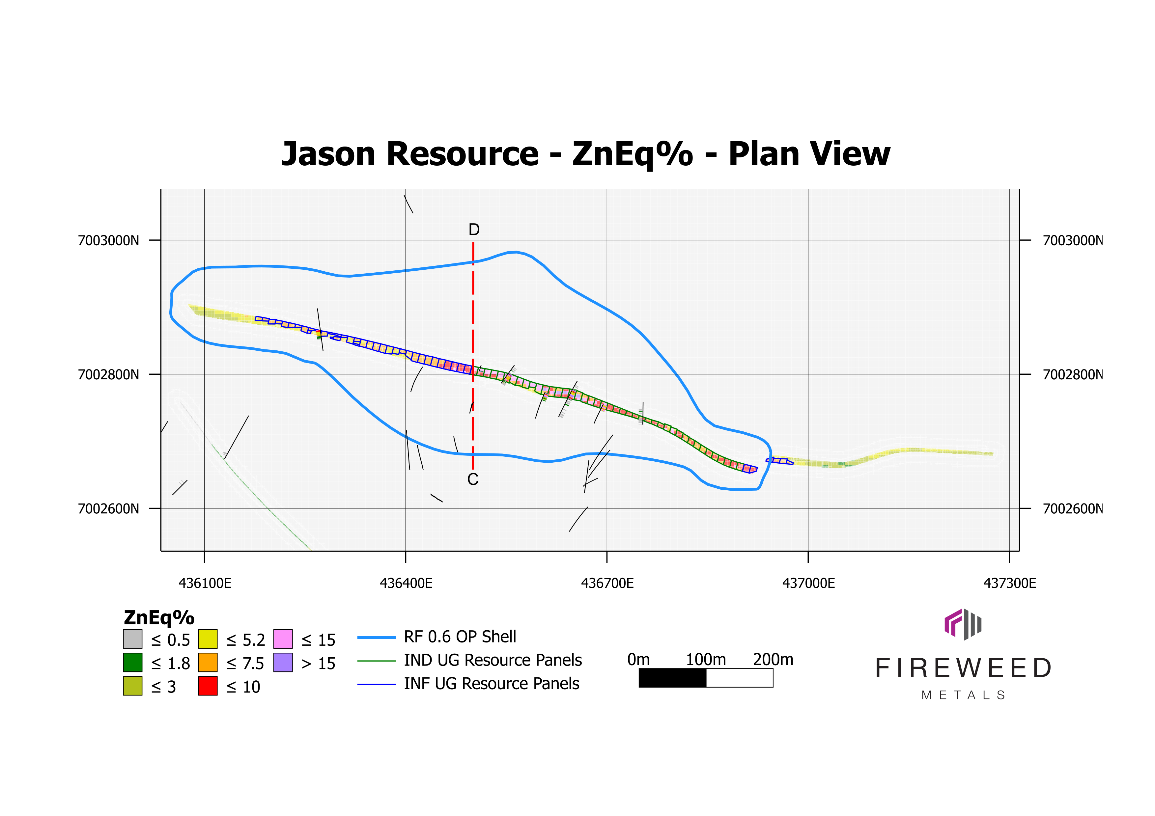

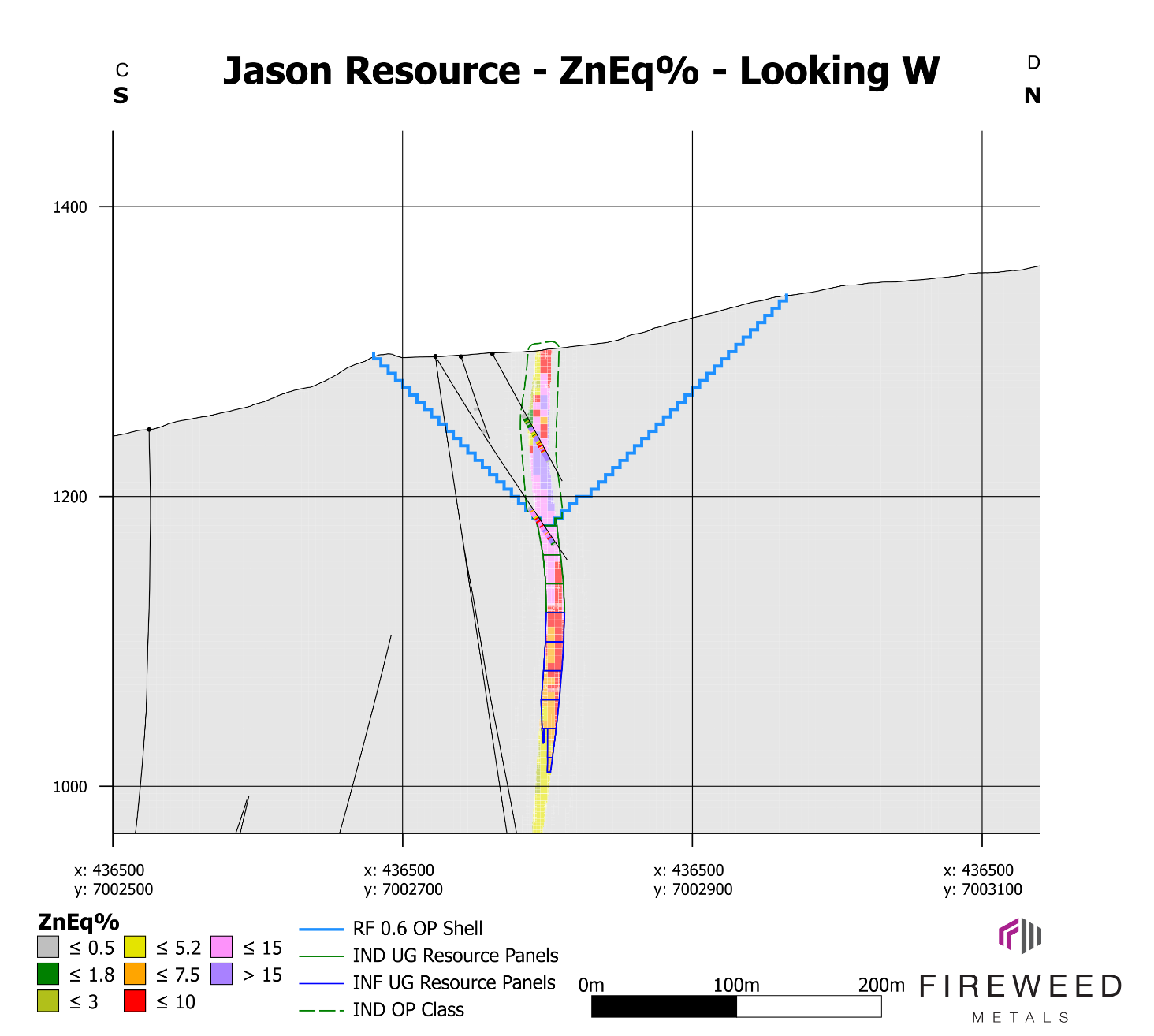

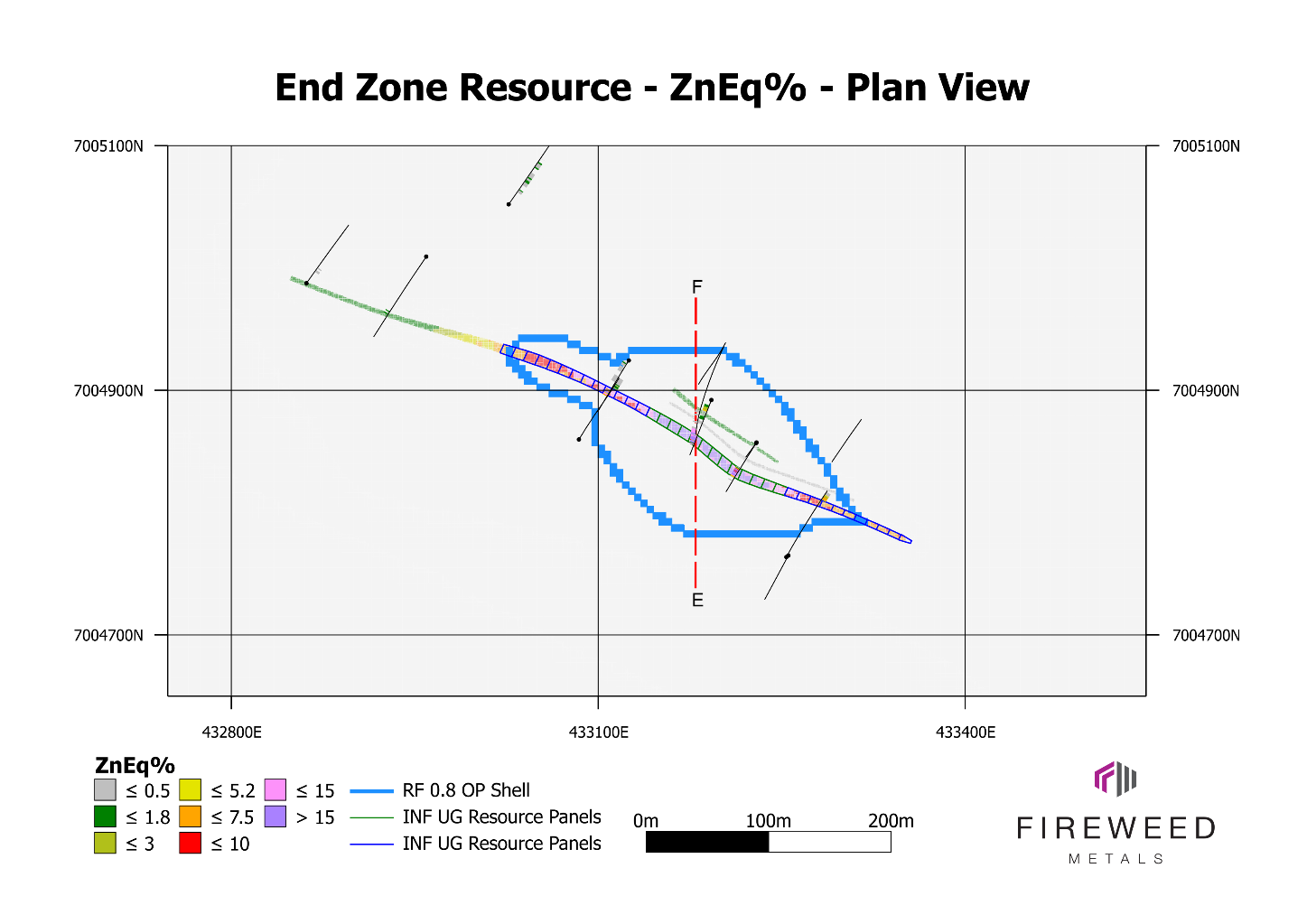

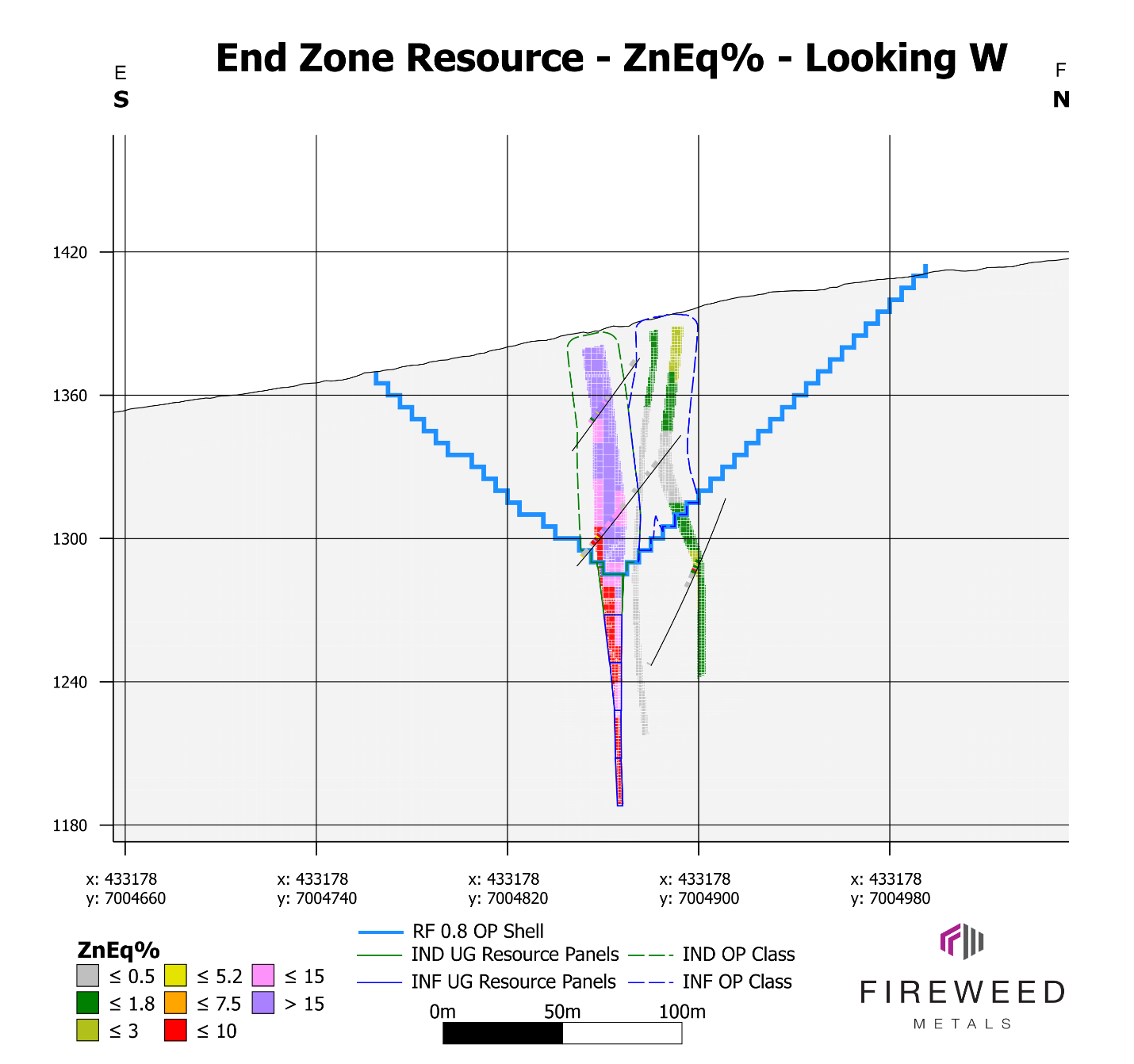

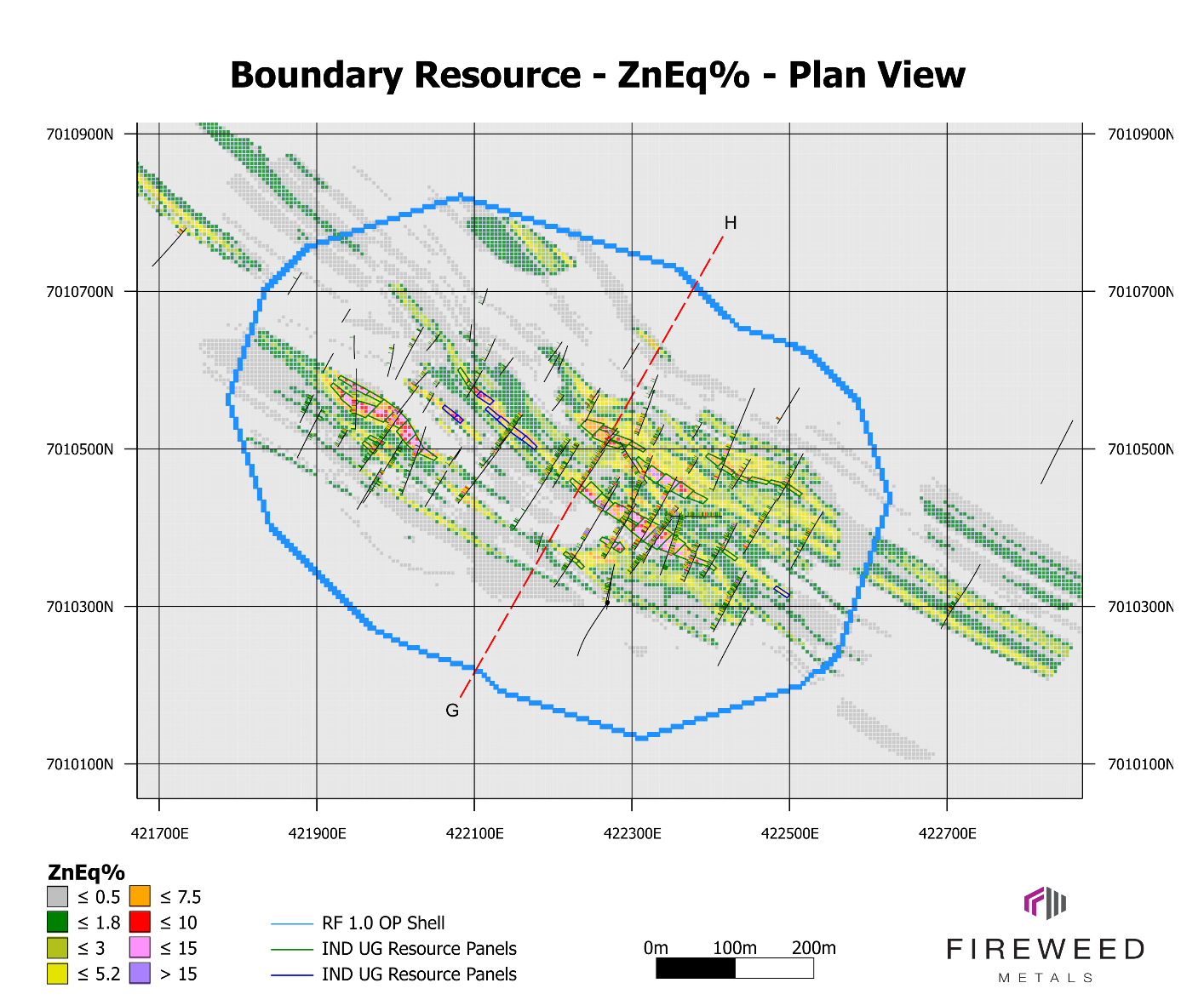

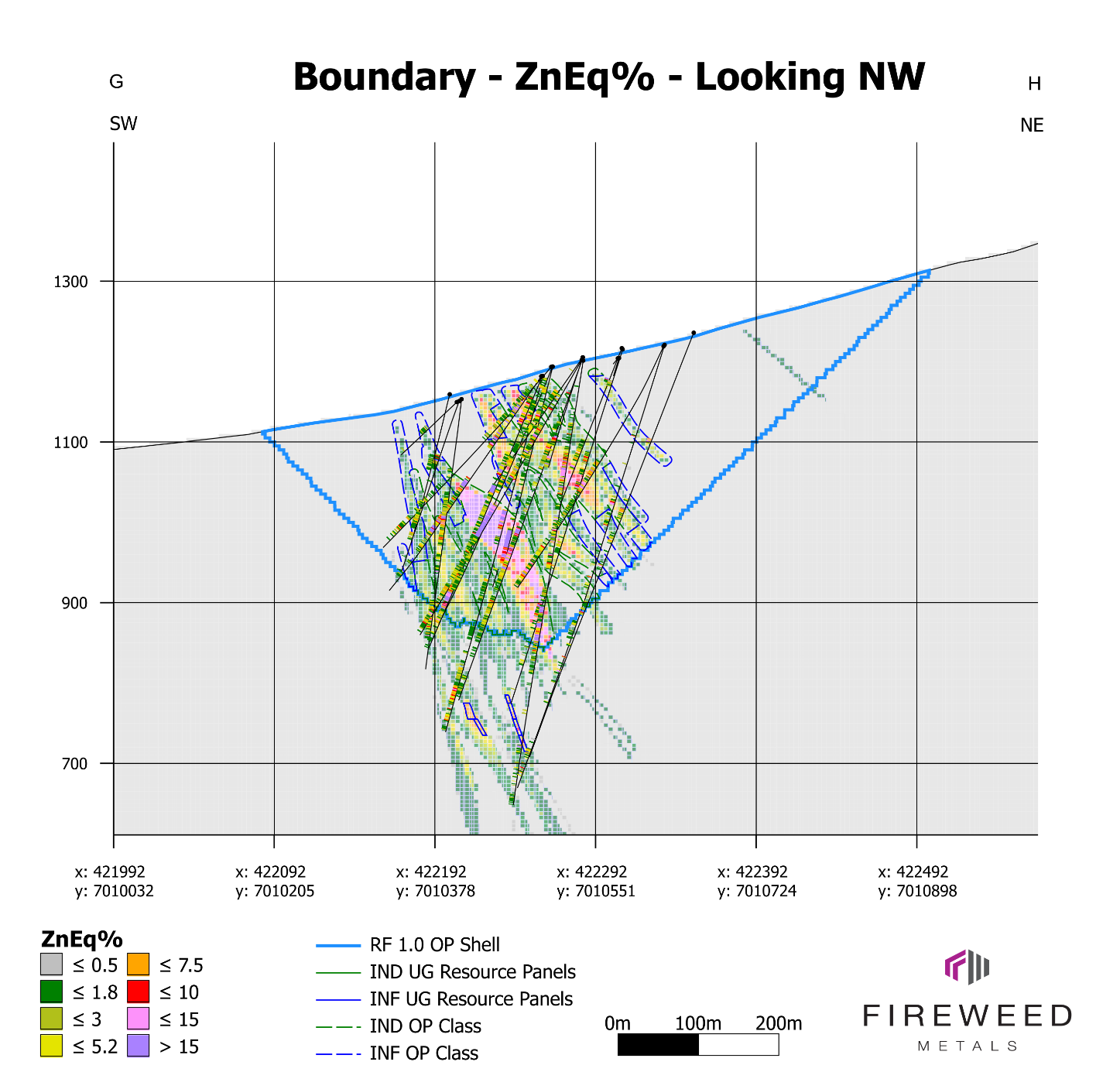

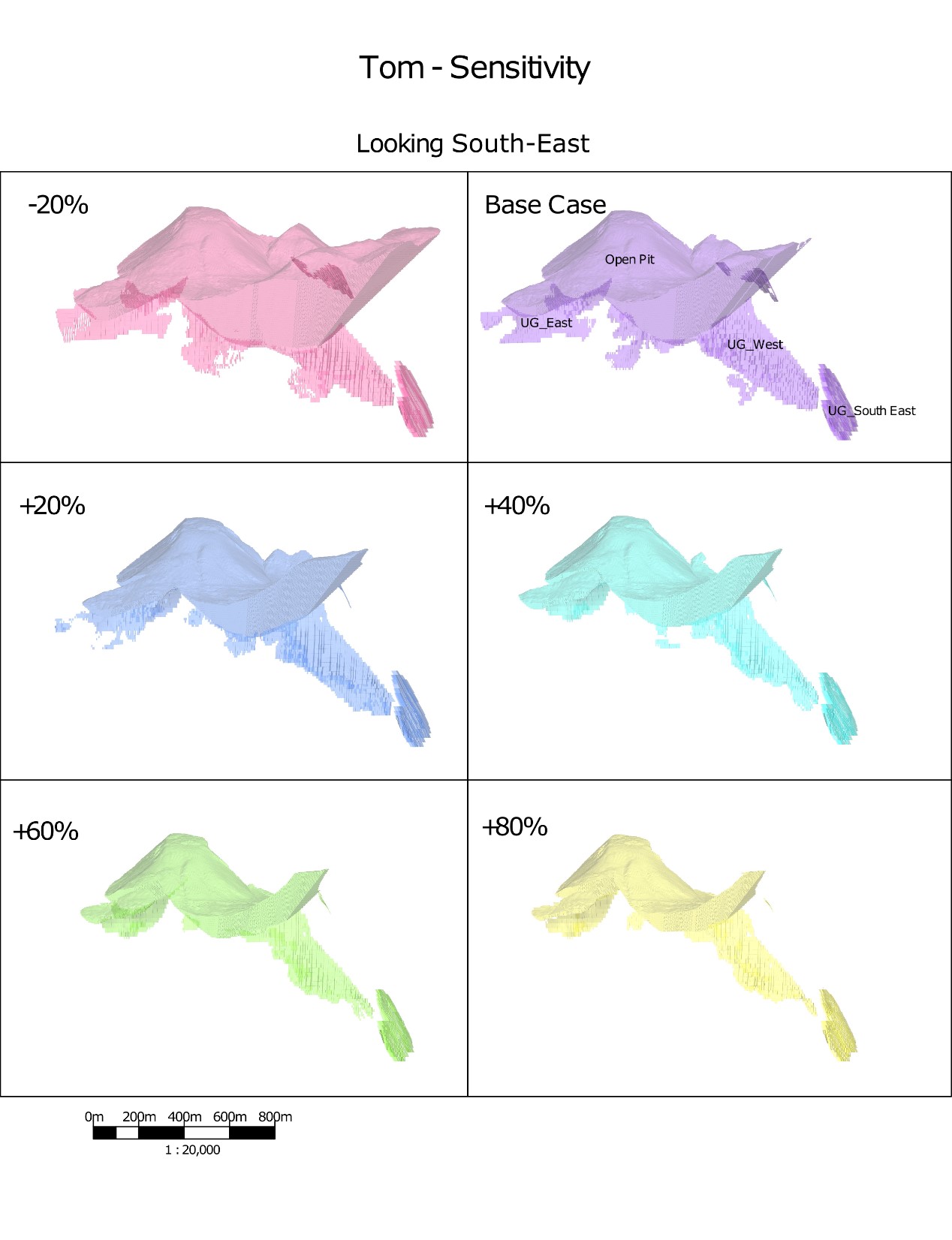

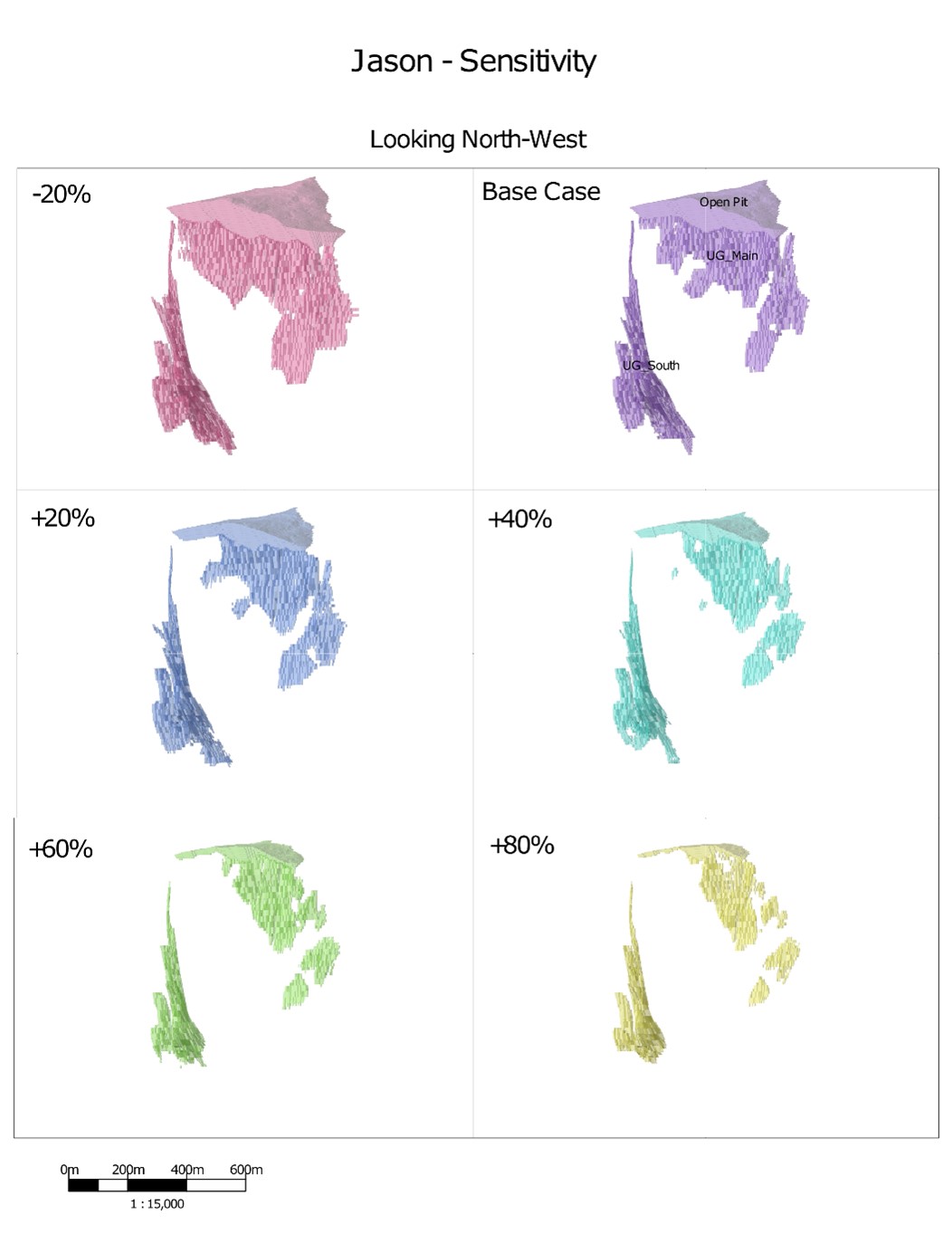

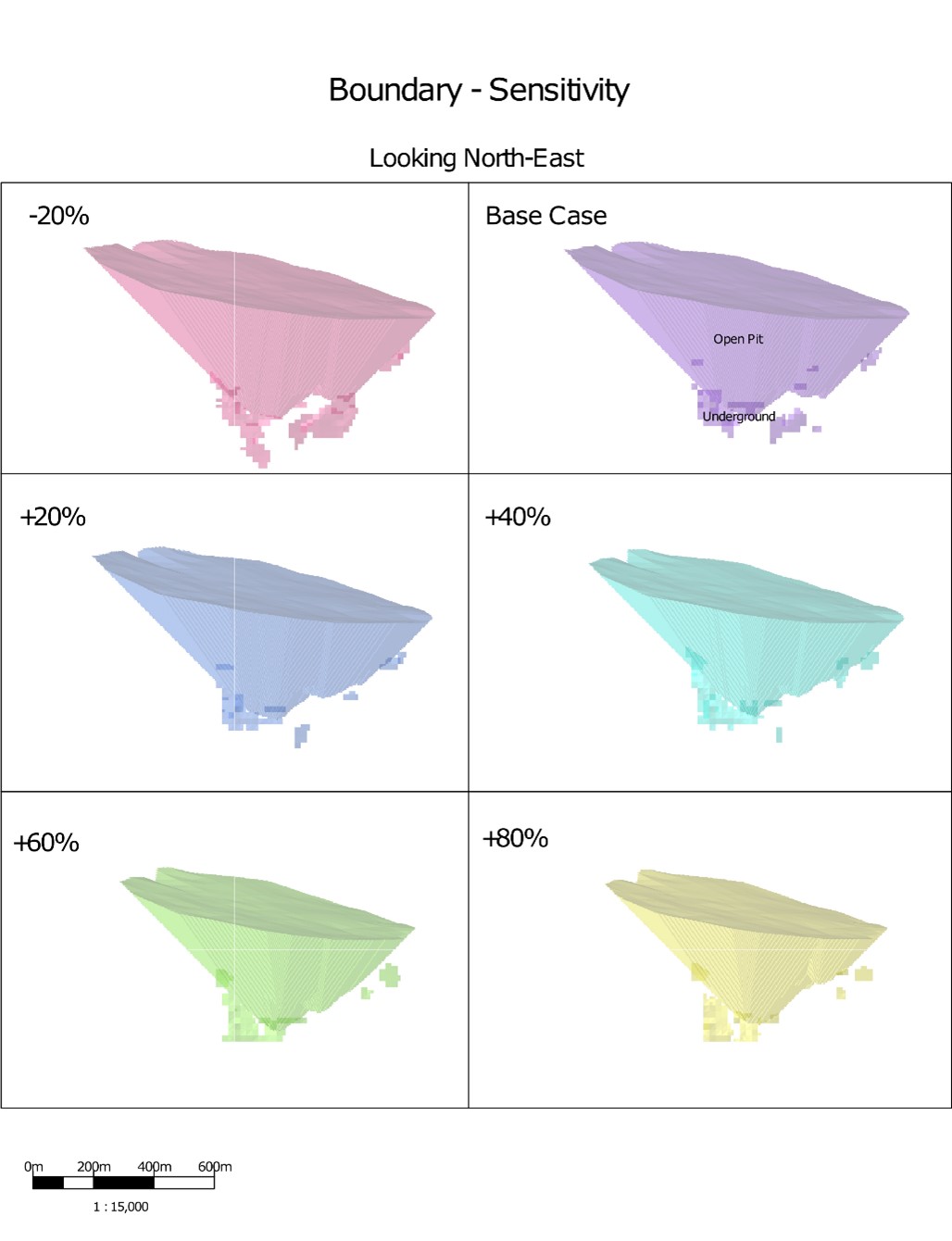

Resources were reported for Inferred or Indicated blocks that are above the stated cut-off within the OP shells, and for all Inferred or Indicated blocks within UG reporting panels that meet the average panel cut-off including all “must-take” internal dilution material within those panels. Tables 5 and 6 show portions of the global resource that are constrained by OP shapes and UG reporting panels, respectively (see Figures 2–9 for block model cross sections, plan views and base case mining shape visualizations).

Table 4: Macpass Revenue Factors and Strip Ratios for Base Case OP Reporting Shells.

| Category | Tom | Jason | End Zone | Boundary Zone |

| Base Case OP Revenue Factor | 0.8 | 0.6 | 0.8 | 1.0 |

| Base Case OP Strip Ratio | 9.4 | 6.2 | 10.0 | 4.9 |

Different revenue factors between 0.6 and 1.0 were selected for each deposit during the OP optimization process. The revenue factor is a scaling parameter applied to the metal prices (or commodity prices) used in the economic evaluation of pit shells. It is expressed as a percentage or factor of the base case (or expected) metal price. For example, a revenue factor of 1.0 corresponds to using the full base case metal prices in the optimization process, while a revenue factor of 0.8 means that the prices used are 80% of the base case prices. This approach was used to optimize the strip ratio, maximize net resource, minimize waste production, limit environmental impacts, and provide a resource suitable for optimizing economics in any future studies (revenue factors and strip ratios are listed in Table 4).

Table 5: Macpass OP Constrained MRE by Deposit

| 2024 SLR Class | Deposit | Tonnes (Mt) | ZnEq(%) | Zn Grade (%) | Pb Grade (%) | Ag Grade (g/t) | Zn Contained Metal (Mlbs) | Pb Contained Metal (Mlbs) | Ag Contained Metal (Moz) |

| Indicated | Tom | 13.63 | 8.60 | 5.84 | 2.63 | 24.1 | 1,754 | 789 | 10.56 |

| Jason | 1.63 | 8.63 | 6.96 | 2.12 | 2.1 | 251 | 76 | 0.11 | |

| End Zone | 0.32 | 16.43 | 3.91 | 12.51 | 87.3 | 28 | 89 | 0.90 | |

| Boundary Zone | 33.50 | 5.46 | 4.72 | 0.53 | 20.9 | 3,486 | 388 | 22.45 | |

| Total Indicated | 49.08 | 6.51 | 5.10 | 1.24 | 21.6 | 5,518 | 1,342 | 34.02 | |

| Inferred | Tom | 4.20 | 10.16 | 6.37 | 3.24 | 39.7 | 591 | 300 | 5.37 |

| Jason | 1.06 | 6.59 | 5.68 | 1.16 | 0.9 | 132 | 27 | 0.03 | |

| End Zone | 0.24 | 9.57 | 2.27 | 7.32 | 50.1 | 12 | 38 | 0.38 | |

| Boundary Zone | 16.90 | 3.63 | 3.39 | 0.21 | 8.9 | 1,260 | 77 | 4.85 | |

| Total Inferred | 22.40 | 5.06 | 4.05 | 0.90 | 14.8 | 1,995 | 442 | 10.63 | |

See Table 1 footnotes

Table 6: Macpass UG Constrained MRE by Deposit

| 2024 SLR Class | Deposit | Tonnes (Mt) | ZnEq (%) | Zn Grade (%) | Pb Grade (%) | Ag Grade (g/t) | Zn Contained Metal (Mlbs) | Pb Contained Metal (Mlbs) | Ag Contained Metal (Moz) |

| Indicated | Tom | 3.90 | 14.46 | 7.93 | 5.85 | 63.9 | 681 | 502 | 8.00 |

| Jason | 2.17 | 9.43 | 8.12 | 1.67 | 1.5 | 388 | 80 | 0.10 | |

| End Zone | 0.02 | 11.43 | 2.16 | 9.07 | 68.0 | 1 | 4 | 0.04 | |

| Boundary Zone | 0.84 | 12.46 | 10.55 | 1.31 | 51.0 | 196 | 24 | 1.38 | |

| Total Indicated | 6.92 | 12.64 | 8.29 | 4.00 | 42.8 | 1,266 | 610 | 9.52 | |

| Inferred | Tom | 14.74 | 8.80 | 6.61 | 2.03 | 21.1 | 2,148 | 660 | 10.00 |

| Jason | 10.59 | 10.78 | 5.46 | 4.65 | 52.9 | 1,274 | 1,085 | 18.01 | |

| End Zone | 0.20 | 7.83 | 1.40 | 6.38 | 45.9 | 6 | 29 | 0.30 | |

| Boundary Zone | 0.56 | 7.35 | 6.29 | 0.84 | 26.6 | 77 | 10 | 0.47 | |

| Total Inferred | 26.09 | 9.56 | 6.09 | 3.10 | 34.3 | 3,505 | 1,784 | 28.79 | |

See Table 1 footnotes

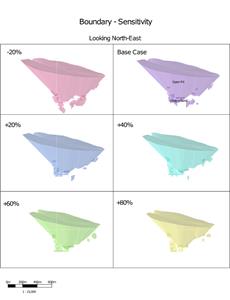

Sensitivity Analysis

Cut-off grade (“CoG”) sensitivity analyses were run on each deposit at increments of 20% NSR cut-off, starting at a -20% scenario and ending with a +80% scenario to determine continuity of mineralization and resiliency of the resource to changes in cost environment or metal pricing (Table 7). A highly robust method was used to perform the sensitivity analysis: new OP shells and UG mining shapes were generated based on each of the revised cut-off values for each sensitivity scenario at each deposit to most accurately reflect mineral resources that would be reported at cut-off values that deviate from the base case scenario. Results show excellent continuity of mineralization within both OP and UG environments across the range of scenarios tested, with contiguous UG reporting panels generating very few isolated outlying reporting panels. Visual representations of these scenarios are presented in Figures 10–12.

Table 7 illustrates the resiliency of the resource to decreases in metal pricing. Keeping cost assumptions fixed at the base case, non-unique example combinations of break-even prices would be approximately: at +20% NSR cut-off USD$1.24/lb Zn, USD$0.97/lb Pb, and USD$22.10/oz Ag; at +40% NSR cut-off USD$1.12/lb Zn, USD$0.88/lb Pb, and USD$20.05/oz Ag; at +60% NSR cut-off USD$1.03/lb Zn, USD$0.81/lb Pb, and USD$18.48/oz Ag; and at +80% NSR cut-off USD$0.97/lb Zn, USD$0.76/lb Pb, and USD$17.28/oz Ag.

Table 7: OP and UG Macpass MRE Cut-Off Sensitivity Analysis

| Scenario NSR CoG | Class | OP/UG | CoG NSR ($/t) | CoG ZnEq % | Tonnes (Mt) | NSR ($/t) | ZnEq. % | Zn % | Pb % | Ag g/t | |

| -20 | % | Ind | OP | 24.0 | 1.10 | 57.19 | 131.7 | 6.39 | 5.00 | 1.37 | 21.9 |

| Base Case | Ind | OP | 30.0 | 1.40 | 49.08 | 130.4 | 6.51 | 5.10 | 1.24 | 21.6 | |

| 20 | % | Ind | OP | 36.0 | 1.70 | 41.78 | 137.7 | 6.68 | 5.38 | 1.33 | 23.7 |

| 40 | % | Ind | OP | 42.0 | 2.00 | 35.27 | 142.5 | 6.91 | 5.57 | 1.38 | 24.8 |

| 60 | % | Ind | OP | 48.0 | 2.30 | 29.89 | 149.3 | 7.24 | 5.85 | 1.44 | 26.7 |

| 80 | % | Ind | OP | 54.0 | 2.50 | 24.31 | 157.3 | 7.63 | 6.19 | 1.48 | 28.9 |

| -20 | % | Inf | OP | 24.0 | 1.10 | 31.19 | 97.4 | 4.72 | 3.87 | 0.78 | 11.7 |

| Base Case | Inf | OP | 30.0 | 1.40 | 22.40 | 103.6 | 5.06 | 4.05 | 0.9 | 14.8 | |

| 20 | % | Inf | OP | 36.0 | 1.70 | 16.98 | 112.5 | 5.46 | 4.28 | 1.06 | 18.0 |

| 40 | % | Inf | OP | 42.0 | 2.00 | 12.99 | 125.6 | 6.09 | 4.64 | 1.29 | 21.7 |

| 60 | % | Inf | OP | 48.0 | 2.30 | 10.06 | 139.9 | 6.78 | 5.01 | 1.55 | 25.8 |

| 80 | % | Inf | OP | 54.0 | 2.50 | 7.20 | 159.9 | 7.75 | 5.47 | 1.96 | 32.3 |

| -20 | % | Ind | UG | 89.6 | 4.20 | 4.22 | 225.2 | 10.92 | 7.59 | 2.97 | 34.5 |

| Base Case | Ind | UG | 112.0 | 5.30 | 6.92 | 259.9 | 12.64 | 8.29 | 4.00 | 42.8 | |

| 20 | % | Ind | UG | 134.4 | 6.30 | 7.45 | 266.9 | 12.94 | 8.34 | 4.05 | 43.1 |

| 40 | % | Ind | UG | 156.8 | 7.40 | 7.62 | 285.9 | 13.87 | 8.94 | 4.38 | 50.4 |

| 60 | % | Ind | UG | 179.2 | 8.40 | 7.04 | 308.2 | 14.95 | 9.39 | 4.89 | 57.9 |

| 80 | % | Ind | UG | 201.6 | 9.50 | 6.44 | 329 | 15.96 | 9.78 | 5.39 | 66.2 |

| -20 | % | Inf | UG | 89.6 | 4.20 | 32.64 | 178.3 | 8.65 | 5.44 | 2.65 | 28.8 |

| Base Case | Inf | UG | 112.0 | 5.30 | 26.09 | 200.3 | 9.56 | 6.09 | 3.10 | 34.3 | |

| 20 | % | Inf | UG | 134.4 | 6.30 | 19.54 | 228.9 | 11.10 | 6.44 | 3.79 | 43.6 |

| 40 | % | Inf | UG | 156.8 | 7.40 | 13.99 | 263.5 | 12.78 | 6.84 | 4.80 | 57.7 |

| 60 | % | Inf | UG | 179.2 | 8.40 | 11.19 | 288.1 | 13.97 | 7.11 | 5.50 | 67.6 |

| 80 | % | Inf | UG | 201.6 | 9.50 | 9.43 | 308.4 | 14.96 | 7.33 | 6.08 | 76.3 |

Tonnes have been reported in millions, rounded to the nearest 10,000.

NSR values were calculated on a block-by-block basis and reported as mass weighted averages for each scenario. Zinc equivalency in this table for non-base case scenarios was approximated using a simplified formula: NSR($/t)/20.62 = ZnEq(%).

All scenarios presented in this table are deemed to meet the requirements for RPEEE.

Base case scenarios are presented as in Tables 5 and 6.

Gallium and Germanium By-Product Potential

Gallium and germanium are critical minerals that occur in elevated concentrations at MacPass. Fireweed has carried out a comprehensive re-assay program for 2017–2023 drilling and selected historical intervals using a specialized assay method that can quantify gallium and germanium—a closed vessel assay (Bureau Veritas method GC204). Fireweed is currently investigating the potential to report by-product germanium and gallium alongside the metals of economic interest in the MRE, zinc, lead, and silver.

Exploration Potential in the Macpass District

The current Mineral Resources at Tom, Jason, and Boundary Zone are open in multiple directions. Geological modeling suggests that the trend of mineralization extends into areas that are untested or for which mineral resources have not been defined. Additional drilling in 2024 is intended to test targets that could expand upon these resources and will be reflected in future updates.

The Tom, Jason, End Zone and Boundary Zone deposits are structurally and stratigraphically controlled feeder-fault systems that occur on splays of the MacMillan-Hess fault system. These feeder-faults occur on roughly 5–10 km centers, within rocks of the Earn and Road River groups. These same fault systems and prospective geology occur throughout the length of the Macpass tenure area, along a pathway referred to as the “prospective corridor” (Figure 1). Historically under-explored for base metals, this prospective corridor is the focus of a significant regional exploration program by Fireweed in 2024 comprising ground gravity geophysical surveys, soil sampling, prospecting, and versatile time-domain electromagnetic (VTEM)-magnetic airborne geophysical surveys.

Figure 1: Deposit locations and simplified genetic model of Macpass: mineralization in the sub-surface environment, with the curved pink lines representing the “stepping” faults controlling the distribution of the deposits. The pink plumes in the schematic cross section represent the sub-surface environment where the early phase of stratiform mineralization at the Tom, Jason, and Boundary Zone deposits formed within the sediment pile, and are displayed prior to any deformation.

Qualified Person Statements and Related Disclosure

Technical information in this news release relating to the MRE has been reviewed and approved by SLR Managing Principal Resource Geologist, Pierre Landry, P.Geo. (BC), a ‘Qualified Person’ as defined under NI 43-101. Mr. Landry is considered to be “independent” of the Company under Section 1.5 of NI 43-101.

All other technical information in this news release has been reviewed and approved by Fireweed Metals’ VP Geology, Dr. Jack Milton, P.Geo. (BC), a ‘Qualified Person’ as defined under NI 43-101. Mr. Milton is not independent of the Company within the meaning of NI 43-101, as he is VP, Geology of the Company.

An NI 43-101 technical report supporting the MRE will be filed on SEDAR+ within 45 days of the date of this news release. Reference should be made to the full text of the technical report for the assumptions, qualifications and limitations relating thereto.

About Fireweed Metals Corp. (TSXV: FWZ; OTCQX: FWEDF; FSE:M0G): Fireweed Metals Corp. is an exploration company unlocking significant value in a new critical metals district located in Yukon, Canada. Fireweed is 100% owner of the Macpass District, a large and highly prospective 977 km2 land package. The Macpass District includes the Macpass zinc-lead-silver project and the Mactung tungsten project, both characterized by meaningful size, grade and opportunity. At Macpass, Fireweed owns one of the largest undeveloped zinc resources worldwide1,3, in a region with enormous exploration upside potential. The Mactung project is a strategic critical metals asset that hosts the world’s largest high-grade tungsten resource1,4 – a potential long-term supply of tungsten for North America. A Lundin Group company, Fireweed is strongly positioned to create meaningful value.

In Canada, Fireweed (TSXV: FWZ) trades on the TSX Venture Exchange. In the USA, Fireweed (OTCQX: FWEDF) trades on the OTCQX Best Market for early stage and developing U.S. and international companies and is DTC eligible for enhanced electronic clearing and settlement. Investors can find Real-Time quotes and market information for the Company on www.otcmarkets.com. In Europe, Fireweed (FSE: M0G) trades on the Frankfurt Stock Exchange.

Additional information about Fireweed and its projects can be found on the Company’s website at FireweedMetals.com and at www.sedarplus.com

ON BEHALF OF FIREWEED METALS CORP.

“Peter Hemstead”

Interim CEO & Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements

Forward Looking Statements

This news release contains “forward-looking” statements and information (“forward-looking statements”). All statements, other than statements of historical facts, included herein, including, without limitation, statements relating to interpretation of drill results, targets for exploration, potential extensions of mineralized zones, future work plans, the use of funds, and the potential of the Company’s projects, are forward looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects”, "anticipates”, "believes”, "intends”, "estimates”, "potential”, "possible”, and similar expressions, or statements that events, conditions, or results "will”, "may”, "could”, or "should” occur or be achieved. Forward-looking statements are based on the beliefs of Company management, as well as assumptions made by and information currently available to Company management and reflect the beliefs, opinions, and projections on the date the statements are made. Forward-looking statements involve various risks and uncertainties and accordingly, readers are advised not to place undue reliance on forward-looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include but are not limited to, exploration and development risks, unanticipated reclamation expenses, expenditure and financing requirements, general economic conditions, changes in financial markets, the ability to properly and efficiently staff the Company’s operations, the sufficiency of working capital and funding for continued operations, title matters, First Nations relations, operating hazards, political and economic factors, competitive factors, metal prices, relationships with vendors and strategic partners, governmental regulations and oversight, permitting, seasonality and weather, technological change, industry practices, uncertainties involved in the interpretation of drilling results and laboratory tests, and one-time events. The Company assumes no obligation to update forward‐looking statements or beliefs, opinions, projections or other factors, except as required by law.

This news release also contains references to estimates of mineral resources. The estimation of mineral resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral resource estimates may require re-estimation based on, among other things: (i) fluctuations in the price of zinc and other metals; (ii) results of drilling; (iii) results of metallurgical testing, process and other studies; (iv) changes to proposed mine plans; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licenses.

Footnotes and References

*Zinc equivalency is based on a price of USD$1.40/lb Zn, USD$1.10/lb Pb, and USD$25/oz Ag, CAD:USD exchange rate of 1.32, and a number of operating cost and metallurgical assumptions specific to each deposit or domain (see Tables 2 and 3).

1References to relative size, grade, and metal content of the Macpass resources and Mactung resources in comparison to other tungsten, zinc, gallium, and germanium deposits elsewhere in the world, respectively, are based on review of the Standard & Poor’s Global Market Intelligence Capital IQ database.

2: The 2018 NI43-101 technical report on the previous mineral resource is available for comparison on https://www.sedarplus.ca/

3: For Tom, Jason, End Zone, and Boundary Zone Mineral Resources, the technical report will be filed on https://www.sedarplus.ca/ within 45 days of September 4, 2024, the effective date of this Mineral Resource.

4: For Mactung Mineral Resources, see Fireweed news release dated June 13, 2023 “Fireweed Metals Announces Mineral Resources for the Mactung Project: the Largest High-Grade Tungsten Deposit in the World*” and the technical report entitled “NI 43-101 Technical Report, Mactung Project, Yukon Territory, Canada,” with effective date July 28, 2023 filed on https://www.sedarplus.ca/. Garth Kirkham, P.Geo. is independent of Fireweed Metals Corp., and a ‘Qualified Person’ as defined under Canadian National Instrument 43-101. Garth Kirkham, of Kirkham Geosystems Limited., is responsible for the Mactung Mineral Resource Estimate.

Contact: Alex Campbell

Phone: +1 (604) 689-7842

Email: info@fireweedmetals.com

Figure 2: Plan View of Tom Block Model, OP shell, drilling traces with assay ZnEq% values. The view is cut at 1450 m above sea level to display the resource extents at 120 m below surface.

Figure 3: Cross section view of Tom block model, OP shell, UG Resource Panels and drilling traces with assay ZnEq% values.

Figure 4: Plan view of Jason block model, OP shell, drilling traces with assay ZnEq% values.. The view is cut at 1120 m above sea level to display the resource extents at 135 m below surface.

Figure 5: Cross section view of Jason block model, OP shell, UG Resource Panels and drilling traces with assay ZnEq% values.

Figure 6: Plan view of End Zone block model, OP shell, drilling traces with assay ZnEq% values. The view is cut at 1350 m above sea level to display the resource extents at 40 m below surface.

Figure 7: Cross section view of End Zone block model, OP shell, UG Resource Panels and drilling traces with assay ZnEq% values.

Figure 8: Plan view of Boundary Zone block model, OP shell, drilling traces with assay ZnEq% values. The view is cut at 1080 m above sea level to display the resource extents at 110 m below surface.

Figure 9: Cross section view of Boundary Zone block model, OP shell, UG Resource Panels and drilling traces with assay ZnEq% values.

Figure 10: Tom Deposit NSR CoG Sensitivity Visualization.

Figure 11: Jason Deposit NSR CoG Sensitivity Visualization.

Figure 12: Boundary Zone NSR CoG Sensitivity Visualization

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1ca724b0-8d32-42fd-b9f5-5343574ebb11

https://www.globenewswire.com/NewsRoom/AttachmentNg/79f43e56-6867-4ab4-99f4-9065c8ba610d

https://www.globenewswire.com/NewsRoom/AttachmentNg/a84da88d-0382-4e8b-b97a-e3bac6cc7b61

https://www.globenewswire.com/NewsRoom/AttachmentNg/5be8df50-a155-4f04-a686-4c09da5f88c0

https://www.globenewswire.com/NewsRoom/AttachmentNg/6cff9705-fa48-4e5c-96dd-b2a2962f0ec8

https://www.globenewswire.com/NewsRoom/AttachmentNg/71e532ca-640c-429d-8c3a-c8a96f5509a9

https://www.globenewswire.com/NewsRoom/AttachmentNg/ed64a188-718e-4641-87a9-e13dd5f9b9af

https://www.globenewswire.com/NewsRoom/AttachmentNg/0164a5b7-ad56-418f-9ef9-5b04cf9a3444

https://www.globenewswire.com/NewsRoom/AttachmentNg/73bfbf85-d136-46da-bef5-4593cc8f5e2e

https://www.globenewswire.com/NewsRoom/AttachmentNg/978b0c1d-17c0-4772-81a8-54e933e57272

https://www.globenewswire.com/NewsRoom/AttachmentNg/dc6b7135-656d-4ef8-87d5-1c31fa1ffb66

https://www.globenewswire.com/NewsRoom/AttachmentNg/4f9b59bc-127d-4e7e-81f4-ef7b1d623132